It can be challenging to know where to start when it comes to estate planning. Since each individual’s circumstances are different, there can be many different options for estate plans. Having a comprehensive estate plan in place can protect you and your loved ones as well as your family’s assets. An estate plan also allows you to make provisions for who will look after your affairs should you become incapacitated or pass away.

Most of all perhaps, having an estate plan in place can give you peace of mind, knowing that your loved ones are protected and your assets will be distributed according to your wishes. Unfortunately, individuals who fail to create adequate estate plans could end up leaving it to the state and courts to decide how assets will be distributed.

We understand that you may have many questions related to your estate planning needs. We have assembled an estate planning FAQ full of questions that we often hear in our practice to help you understand what an estate plan and estate planning attorney can do for you. However, you should consider consulting with an experienced estate planning attorney who can advise you thoroughly and create the right plan for your unique circumstances. Contact our legal team at the Johnson Law Group for a free consultation today by phone (720) 463-4333, or text to chat (720) 730-4558.

An estate plan details the transfer of a person’s assets, such as real estate, investments, and retirement accounts after they pass away. Estate plans can vary greatly and involve trusts, wills, power of attorney, and healthcare provisions. However, many Americans delay making plans for their estate. According to the American Association of Retired Persons (AARP), most people failing to tackle estate planning either had not gotten around to it or did not think that they had enough assets.

One misconception we frequently encounter is that estate planning is only for the wealthy. While estate planning is certainly a must for those with a considerable portfolio of assets, having a solid estate plan can be beneficial for each and every individual. Even if you do not own any assets other than a house, car, and bank account, having an estate plan can have many benefits. If you do not have a valid estate plan, you risk your state deciding what happens to your assets should you unexpectedly pass away or become incapacitated.

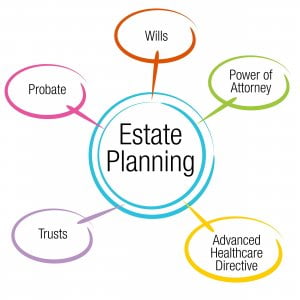

An estate plan can be personalized depending on the wishes and circumstances of the individual and their family. However, generally, a comprehensive estate plan can include the following:

A Last Will and Testament (will) ensures that assets will be distributed to beneficiaries according to your wishes following your death. It is important to note that a will needs to be worded correctly in order to have full legal validity. You could also consider establishing a revocable or irrevocable trust, depending on your personal circumstances. Trusts can help to lower estate taxes as well as manage assets. In some cases, it may be best to have both a will and a trust. Every person will have different circumstances and estate planning needs.

Adding a designation for durable power of attorney to your estate plan can be extremely important as it allows you to assign a person of your trust as your agent. They can then act on your behalf if you become incapacitated. Not having power of attorney means that a court could decide what happens to your assets. Many individuals choose their spouse as their designated agent, however, you could also choose a trusted advisor or friend.

It can be an excellent idea to add a healthcare power of attorney to your estate plan. This would typically be your spouse or close family member, or anyone else you trust with your life. They can then make medical decisions for you if you become unable to do so yourself.

Guardianship designations only apply if you have any minor children (or older children with special needs) to consider. Selecting a guardian in case of your and your spouse’s death or incapacity is a critical and important decision. The failure to name a guardian means that a court could rule where your children will live and with whom.

An estate plan can also include other important designations and documents. However, since the details of a plan will depend on your circumstances and wishes, you should contact an estate planning attorney for help and guidance for your specific situation and needs. An estate planning attorney at Johnson Law Group can also provide more detailed answers to the questions found in this estate planning FAQ.

When you start to research estate planning, you will likely come across internet sources and downloadable forms. While these can give you a general idea of the information and documents required for setting up an estate plan, a legally valid and comprehensive estate plan can encounter serious legal issues and challenges if done as a DIY project. Drawing up the legal paperwork should be done by a seasoned estate planning attorney who is familiar with federal and state laws and can ensure that your estate plan is legally valid. A missed signature or unclear wording can create significant problems for your beneficiaries, potentially leading them to spend hundreds or thousands of dollars on attorneys in order to get their inheritance.

If an individual’s situation is somewhat complicated, the assistance of an estate planning attorney can be crucial. Your lawyer can ensure that your estate plan is “bulletproof” in case someone tries to contest your will. An experienced estate planning attorney can also establish your estate plan in a way that helps avoid unnecessary taxes for your heirs and also potentially even avoids probate. Having an estate plan drawn up professionally can mean that your beneficiaries will receive their inheritance faster, and save on taxes as well as legal fees. If you set up your estate plan with an experienced estate planning attorney, you could potentially save your loved ones considerable legal challenges after your death.

You likely have many more questions with respect to your individual needs for your estate plan. While you may know that an estate plan can bring you peace of mind and reassurance, you may remain unsure of what types of legal documents you need to ensure your wishes are carried out. While this estate planning FAQ can give you a general idea of certain types of estate planning documents, an experienced attorney can offer you individual care and attention. We are here to help you build your personalized estate plan. Contact the Johnson Law Group today for a complimentary consultation by phone (720) 463-4333, or text to chat (720) 730-4558.

Join our email list to receive the latest news and updates from our Family Law Team.

Thank you for subscribing to Johnson Law Group. You will now start receiving important information.